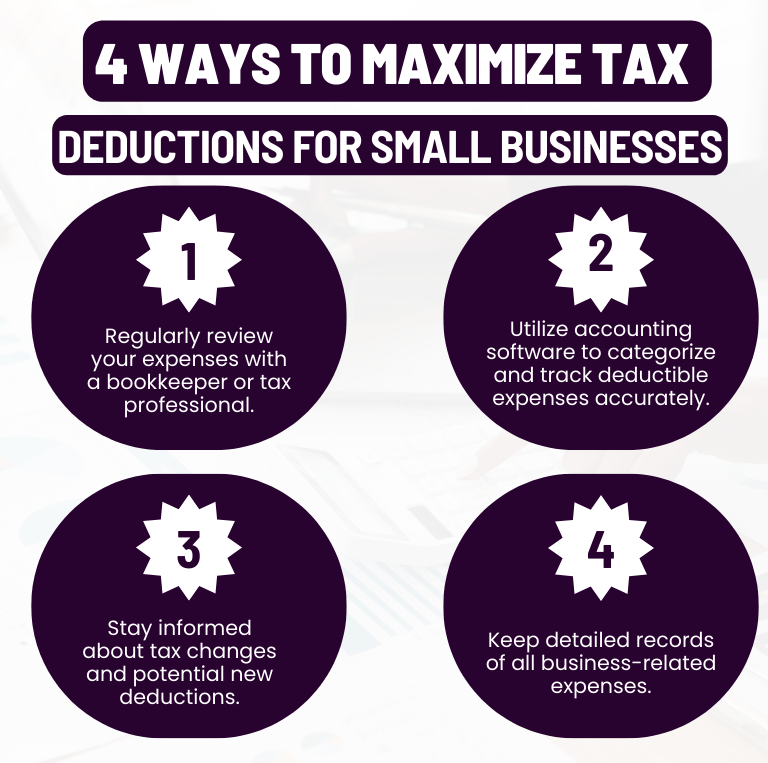

4 Ways to Maximize Tax Deductions for Small Businesses

How a Bookkeeper Can Help You Save Money

Maximizing tax deductions is a priority for any small business owner, as it helps reduce taxable income and, ultimately, your tax liability. However, identifying eligible deductions and tracking expenses can be a daunting task, especially for busy entrepreneurs who are focused on running their businesses. Missing out on key deductions can result in higher taxes, while improper documentation can lead to costly mistakes during tax season.

With 20 years of experience, I understand the importance of optimizing tax deductions and ensuring that every legitimate expense is accounted for. In this blog, I’ll explore four essential ways to maximize tax deductions for your small business and explain how partnering with a professional bookkeeper can help you make the most of every opportunity to save money.

1. Regularly Review Your Expenses with a Bookkeeper or Tax Professional

One of the most effective ways to maximize your tax deductions is to regularly review your expenses with a bookkeeper or tax professional. A thorough review of your business expenses allows you to identify deductions that you may have overlooked and ensures that all eligible expenses are properly categorized. Regular expense reviews also help you spot any inconsistencies or errors, ensuring that your records are accurate and tax compliant.

Many small business owners aren’t aware of all the potential deductions available to them. For example, home office expenses, vehicle-related costs, and business meals can all be partially deductible if they meet the IRS’s criteria. Regularly reviewing your expenses with a knowledgeable professional ensures that you don’t miss out on these valuable deductions.

A bookkeeper will work with you to conduct regular expense reviews, identifying potential deductions and ensuring that all your business expenses are accurately recorded. They stay up to date on the latest tax laws and regulations, helping you take advantage of all the deductions you’re entitled to. With a bookkeeper by your side, you can rest assured that your financial records are in order, and you’re not leaving money on the table.

2. Utilize Accounting Software to Categorize and Track Deductible Expenses Accurately

Using accounting software to categorize and track deductible expenses is a game-changer for small businesses. Manual bookkeeping is not only time-consuming, but it can also lead to errors that result in missed deductions or improper expense tracking. Accounting software automates many aspects of bookkeeping, making it easier to keep your records organized and accurate.

By categorizing expenses correctly, accounting software helps ensure that deductible expenses are easily identifiable when it’s time to file your taxes. For example, the software can separate expenses related to office supplies, travel, marketing, and other business categories, so you know exactly how much you’ve spent in each area. This level of organization makes it easier to claim deductions and reduces the likelihood of mistakes.

A professional bookkeeper will set up and maintain your accounting software, ensuring that all of your business expenses are categorized accurately. They’ll track deductible expenses in real time and make sure that every eligible cost is properly documented. With the right accounting tools in place, a bookkeeper can streamline your tax preparation process and maximize your deductions.

3. Stay Informed About Tax Changes and Potential New Deductions

Tax laws and regulations change frequently, and staying informed about these changes is critical to maximizing your deductions. Every year, new deductions may be introduced, while existing ones may be adjusted or eliminated. It’s essential for small business owners to stay up to date on these changes to ensure that they’re taking full advantage of all available tax breaks.

A bookkeeper stays informed about the latest tax law changes and how they impact your business. They’ll notify you of any new deductions or tax-saving opportunities and help you adjust your financial strategies accordingly. By working with a knowledgeable bookkeeper, you can take advantage of every opportunity to reduce your tax liability while remaining compliant with IRS regulations.

4. Keep Detailed Records of All Business-Related Expenses

The key to claiming deductions is having proper documentation for all your business-related expenses. The IRS requires detailed records to support your deduction claims, and failing to provide adequate documentation can lead to penalties or the disallowance of deductions.

Keeping detailed records involves saving receipts, invoices, and any other documentation related to your business expenses. This is particularly important for expenses that are subject to strict IRS rules, such as business meals, travel, and home office deductions. Proper record-keeping ensures that you can substantiate your deductions in the event of an audit and provides you with peace of mind knowing that your financial records are in order.

A bookkeeper will ensure that all of your business-related expenses are properly documented and organized. They’ll implement systems for tracking receipts, invoices, and other records, making it easy for you to access the documentation you need during tax season. With their help, you can confidently claim deductions, knowing that your records meet IRS standards.

Maximizing tax deductions is one of the best ways to reduce your tax liability and keep more money in your business. However, doing so requires careful expense tracking, accurate record-keeping, and staying informed about the latest tax laws. Partnering with a professional bookkeeper ensures that you’re taking full advantage of every tax-saving opportunity while keeping your financial records organized and compliant.

At Beaver Bookkeeping, we specialize in helping small businesses maximize their tax deductions and streamline their bookkeeping processes. With over 20 years of experience, we’re here to ensure that your financial records are accurate, up to date, and ready for tax season. Contact us today to learn how we can help you save time and money through expert bookkeeping services.

Want to make sure you’re maximizing your tax deductions? Contact Beaver Bookkeeping today for a free consultation and see how we can help you save money with smart bookkeeping strategies!