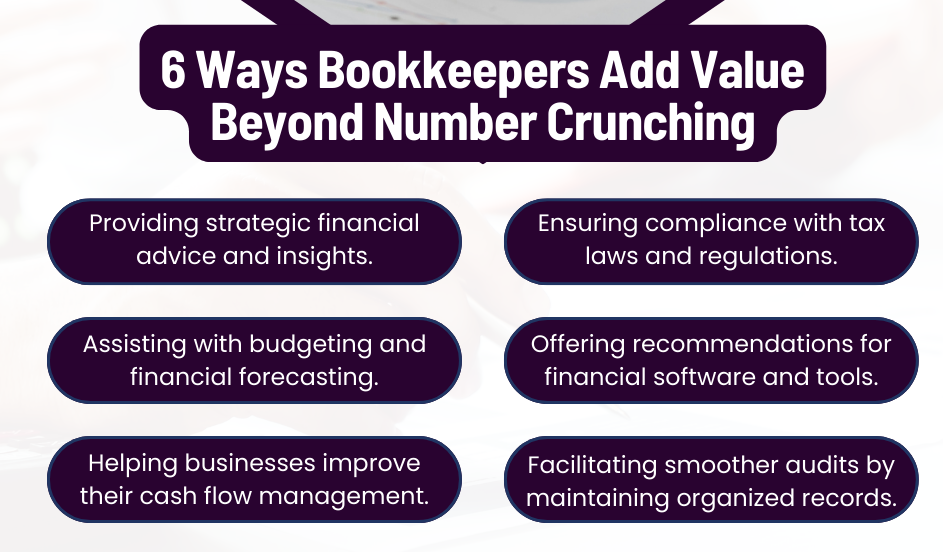

6 Ways Bookkeepers Add Value Beyond Number Crunching

How a Bookkeeper Can Support Your Small Business Growth

Bookkeeping is often viewed as a basic, necessary task of recording transactions and managing expenses. However, professional bookkeepers offer far more than simple number crunching. A skilled bookkeeper can be an invaluable asset to small business owners, providing insights, guidance, and strategies that go beyond balancing the books.

In this blog, we’ll explore six powerful ways that bookkeepers add value beyond data entry, focusing on how partnering with a bookkeeper can help you make informed decisions, streamline operations, and achieve your financial goals.

1. Providing Strategic Financial Advice and Insights

One of the most valuable contributions a bookkeeper can make is offering strategic financial advice. By analyzing your financial data, bookkeepers provide insights that help you understand your business’s strengths and areas for improvement. They can identify trends in your revenue and expenses, highlight growth opportunities, and warn you about potential financial challenges.

For example, if your business has a seasonal sales cycle, a bookkeeper can help you prepare for fluctuations in cash flow, ensuring you have the funds to cover operational expenses even during slower months. With their insights, you can make better-informed decisions about hiring, investing, and expanding.

A bookkeeper goes beyond simply recording data; they interpret financial information and provide advice that supports your business strategy. This helps you stay proactive and set realistic financial goals.

2. Ensuring Compliance with Tax Laws and Regulations

Staying compliant with tax laws and regulations is essential for every business, but it can be overwhelming to keep track of changing tax codes, filing deadlines, and deduction rules. Bookkeepers ensure that your business remains compliant by maintaining accurate records, preparing for tax season, and staying updated on any regulatory changes that affect your industry.

In addition, a bookkeeper can help you take advantage of tax-saving opportunities, such as deductions and credits, which may not be obvious to a busy business owner. By minimizing your tax liability, a bookkeeper helps you retain more of your revenue.

With a bookkeeper’s help, you can avoid costly penalties and fees for non-compliance, saving you both time and money. They ensure that your business follows all necessary regulations, giving you peace of mind.

3. Assisting with Budgeting and Financial Forecasting

Budgeting and forecasting are critical to managing your business’s finances effectively. A bookkeeper assists you in creating a realistic budget based on historical data and future projections. They analyze past trends to help you set achievable revenue and expense targets, as well as plan for potential challenges.

With accurate forecasting, you can make strategic investments, allocate resources more effectively, and avoid cash flow issues. Whether you’re planning for growth, adding new products, or expanding into new markets, budgeting and forecasting provide a roadmap for sustainable success.

A bookkeeper provides the financial clarity you need to set and meet realistic financial goals. By supporting your budgeting and forecasting processes, they help you make data-driven decisions that promote growth.

4. Offering Recommendations for Financial Software and Tools

Navigating the world of financial software can be daunting, especially with the wide variety of options available. A bookkeeper can recommend the best accounting software and tools based on your business’s needs and budget. By setting up software that automates tasks like invoicing, expense tracking, and reporting, you’ll save time and reduce the risk of manual errors.

Furthermore, bookkeepers can help you integrate these tools with your existing systems, ensuring a smooth workflow. With the right technology in place, you can streamline operations, improve accuracy, and access real-time financial data for better decision-making.

A bookkeeper helps you choose and implement the right financial tools, empowering you to manage your finances efficiently. They ensure you’re using technology to its full potential, saving you time and enhancing productivity.

5. Helping Businesses Improve Their Cash Flow Management

Cash flow is the lifeblood of any business. Without proper cash flow management, even profitable companies can run into trouble. Bookkeepers monitor your cash flow closely, tracking when payments are expected, managing expenses, and advising you on ways to improve your cash flow cycle.

For instance, a bookkeeper may recommend implementing early payment discounts for clients, adjusting payment terms, or optimizing inventory levels to avoid tying up cash in stock. By helping you manage cash flow effectively, a bookkeeper ensures that you always have the funds needed to cover operating costs and invest in growth opportunities.

A bookkeeper helps you avoid cash shortages by managing cash flow strategically. They provide guidance to improve liquidity, reduce financial stress, and keep your business financially stable.

6. Facilitating Smoother Audits by Maintaining Organized Records

Audits can be stressful for any business owner, but having well-organized records makes the process much smoother. A bookkeeper maintains accurate, up-to-date records, ensuring that all transactions are documented and properly categorized. This reduces the risk of errors and makes it easier to provide auditors with the information they need.

Whether it’s an internal audit for management purposes or an external audit required by investors or regulatory agencies, organized records streamline the audit process and demonstrate transparency. This not only saves time but also builds trust with stakeholders.

By maintaining clear and organized records, a bookkeeper helps you navigate audits with ease. Their meticulous record-keeping practices ensure that you’re always audit-ready, minimizing disruptions to your business.

Bookkeepers do so much more than track income and expenses. They offer strategic support that goes beyond number crunching, providing valuable insights, ensuring compliance, managing cash flow, and streamlining operations. Partnering with a professional bookkeeper gives you access to expertise that can help your business thrive and grow.

At Beaver Bookkeeping, we’re dedicated to helping small businesses reach their full potential through personalized bookkeeping services. With over 20 years of experience, we understand the unique challenges business owners face, and we’re here to offer support at every step. Whether you need budgeting assistance, compliance guidance, or cash flow management, we’re ready to help you succeed.

Ready to experience the benefits of a dedicated bookkeeper? Contact Beaver Bookkeeping today for a free consultation and see how we can help you add value to your business beyond the numbers!