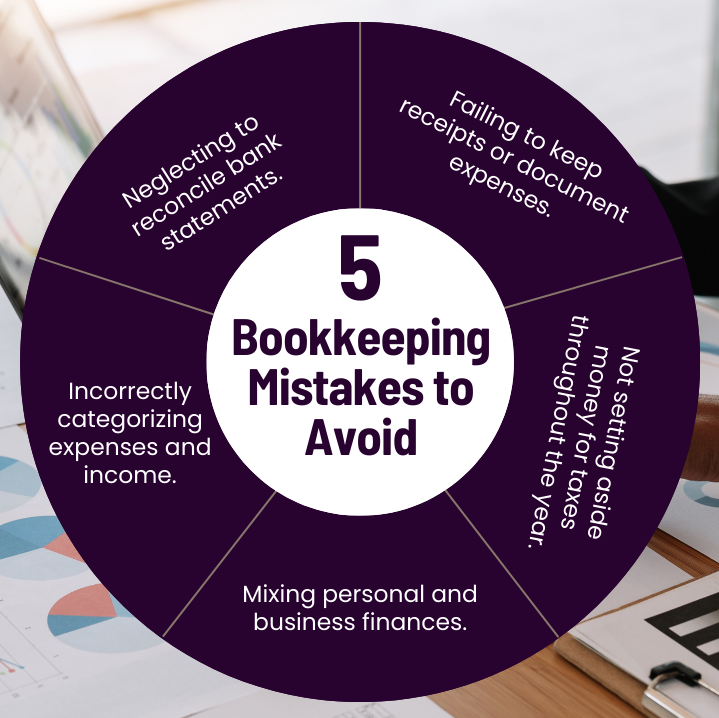

5 Bookkeeping Mistakes to Avoid

How a Bookkeeper Can Help Your Small Business Stay on Track

Bookkeeping is the backbone of any successful business, no matter the size. For small business owners, keeping your financial records in order is crucial for making informed decisions, ensuring smooth cash flow, and meeting tax obligations. However, many small business owners, especially those without a dedicated bookkeeper, can make mistakes that lead to costly financial errors.

With 20 years of experience, I’ve seen firsthand the impact that common bookkeeping mistakes can have on a business. From miscategorized expenses to failing to document receipts, these errors can snowball into bigger problems down the line. In this blog, I’ll discuss five of the most common bookkeeping mistakes that small business owners should avoid and explain how partnering with a professional bookkeeper can help you steer clear of these pitfalls.

1. Neglecting to Reconcile Bank Statements

Bank reconciliation is the process of comparing your financial records with your bank statements to ensure that every transaction is accounted for and that no discrepancies exist. This is a vital step in maintaining accurate financial records. However, many small business owners neglect to reconcile their bank statements regularly, leading to errors that can go unnoticed for months.

Failing to reconcile your bank accounts can result in missed expenses, unrecorded income, or even overlooked fraudulent charges. These discrepancies can create inaccuracies in your financial reports, which can make it difficult to manage cash flow and make informed financial decisions.

A bookkeeper will handle the task of reconciling your bank statements monthly or even weekly, depending on your needs. They’ll ensure that your financial records are accurate and up to date, giving you a clear picture of your business’s financial health. With regular bank reconciliation, you can catch errors or discrepancies early, before they cause bigger issues.

2. Failing to Keep Receipts or Document Expenses

One of the most common mistakes small business owners make is failing to keep receipts or properly document their expenses. Whether it’s due to being too busy or simply forgetting, neglecting to track your expenses can lead to lost deductions at tax time and may raise red flags with the IRS.

Without proper documentation, it becomes difficult to justify your expenses in the event of an audit. Moreover, undocumented expenses can lead to inaccurate financial statements, making it harder to manage your cash flow and budget effectively.

A bookkeeper will establish and maintain a system for tracking and documenting your expenses. They’ll ensure that every business expense is properly recorded and categorized, making it easier to claim deductions during tax season. A professional bookkeeper can also help you implement tools like receipt scanning apps, which streamline the process of keeping track of receipts and expenses.

3. Not Setting Aside Money for Taxes Throughout the Year

Small business owners often fall into the trap of not setting aside money for taxes throughout the year. When tax season rolls around, they find themselves scrambling to come up with the funds needed to pay their tax bill. This can lead to cash flow issues, penalties for late payments, or even tax debt that accumulates over time.

Failing to plan for taxes is a recipe for financial stress. Without a tax-saving strategy in place, you may be caught off guard by how much you owe, especially if your business has seen significant growth.

A bookkeeper helps you stay on top of your tax obligations by advising you on how much to set aside for taxes throughout the year. They will work with your tax advisor or accountant to ensure that your tax planning is integrated into your overall financial strategy. By setting aside a portion of your income each month, you’ll avoid the shock of a large tax bill and stay prepared.

4. Incorrectly Categorizing Expenses and Income

Another common bookkeeping mistake is incorrectly categorizing expenses and income. When your financial transactions are not properly categorized, it can lead to misleading financial reports. For example, you might think your business is more profitable than it actually is if some expenses are incorrectly categorized as income, or vice versa.

This can create a distorted view of your business’s performance, making it difficult to create accurate budgets, make informed decisions, or secure financing. Additionally, miscategorized transactions can complicate tax preparation and lead to missed deductions.

A professional bookkeeper ensures that all of your financial transactions are accurately categorized. They understand the various categories of expenses and income and will ensure that everything is recorded correctly in your accounting system. This helps you avoid errors that can distort your financial statements and lead to problems during tax season.

5. Mixing Personal and Business Finances

One of the most detrimental bookkeeping mistakes small business owners make is mixing personal and business finances. When you use the same bank account or credit card for both personal and business expenses, it becomes nearly impossible to keep track of your business’s true financial health.

Mixing finances can lead to inaccurate records, making it harder to track your business’s cash flow, claim tax deductions, and provide accurate financial statements for investors or lenders. In the event of an audit, it can also be difficult to prove which expenses are business-related and which are personal.

A bookkeeper will help you establish and maintain a clear separation between your personal and business finances. They can assist you in setting up separate business bank accounts and credit cards, and they’ll ensure that all transactions are accurately recorded in the correct accounts. By keeping your finances separate, you’ll have a clearer picture of your business’s performance and make tax filing much easier.

Bookkeeping is a critical component of managing a successful business, yet it’s an area where many small business owners make avoidable mistakes. From neglecting bank reconciliation to mixing personal and business finances, these common errors can lead to financial mismanagement, lost deductions, and even tax penalties.

Partnering with a professional bookkeeper can help you avoid these pitfalls and keep your business’s financial health on track. A bookkeeper not only saves you time and stress but also ensures that your financial records are accurate, up to date, and compliant with tax laws. With their expertise, you can focus on running and growing your business, confident that your finances are in good hands.

At Beaver Bookkeeping, we specialize in helping small businesses maintain accurate financial records and avoid common bookkeeping mistakes. With over 20 years of experience, we’re here to ensure that your business stays on track and that you have the financial information you need to make informed decisions. Contact us today to learn how we can help you manage your bookkeeping and grow your business.