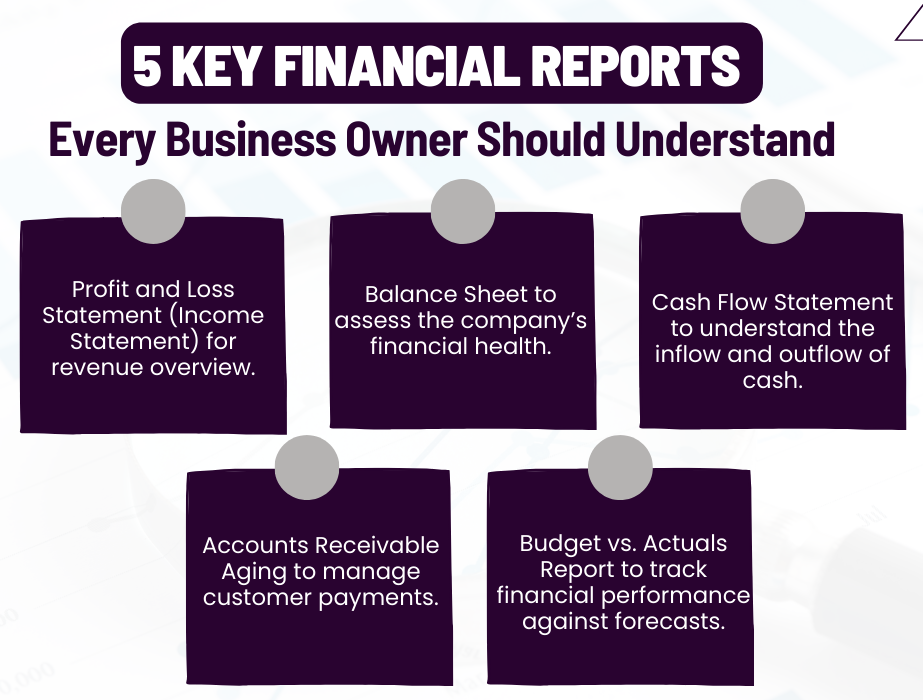

5 Key Financial Reports Every Business Owner Should Understand

How a Bookkeeper Can Help You Stay on Top of Your Finances

Running a small business involves wearing many hats, and one of the most important is managing your business’s finances. Without a clear understanding of your financial position, making informed decisions becomes challenging. Key financial reports are essential tools that provide insights into your business’s performance, helping you gauge profitability, cash flow, and overall financial health.

With 20 years of experience, I’ve seen how understanding and utilizing financial reports can help small business owners achieve their goals. In this blog, we will explore five critical financial reports that every business owner should understand, explaining how each report provides valuable insights. Partnering with a professional bookkeeper will not only help you create and maintain these reports but will also enable you to use them strategically to grow your business.

1. Profit and Loss Statement (Income Statement) for Revenue Overview

The Profit and Loss Statement (P&L), also known as the Income Statement, is one of the most critical financial reports for any business. It provides a summary of your company’s revenues, costs, and expenses over a specific period, typically monthly, quarterly, or annually. The P&L shows whether your business is generating a profit or operating at a loss, making it essential for assessing overall performance.

This report helps you identify trends in your income and expenses, allowing you to make decisions that improve profitability. For example, if you notice that certain expenses are consistently higher than expected, you can take steps to reduce those costs. Similarly, tracking revenue trends helps you understand which products or services are contributing the most to your bottom line.

A bookkeeper will ensure that your Profit and Loss Statement is accurate and up to date. They’ll track your income and expenses regularly and generate monthly or quarterly P&L reports for you to review. By keeping these records organized, your bookkeeper allows you to focus on making strategic decisions based on real-time financial data.

2. Balance Sheet to Assess the Company’s Financial Health

The Balance Sheet is a snapshot of your company’s financial position at a specific point in time. It outlines what your business owns (assets), what it owes (liabilities), and what’s left over for the owners (equity). The Balance Sheet provides a clear picture of your business’s overall financial health, showing how much of your assets are financed by debt versus equity.

This report helps you assess whether your business is solvent, which is crucial when applying for loans, seeking investors, or evaluating the sustainability of your operations. A strong balance sheet reflects a healthy business, while a weak one may signal the need to improve cash flow, reduce debt, or reassess asset management.

A professional bookkeeper ensures that your Balance Sheet accurately reflects your business’s financial position. They will regularly update this report, giving you a clear view of your assets and liabilities. With this information in hand, you can make informed decisions about investing in new equipment, hiring additional staff, or expanding your operations.

3. Cash Flow Statement to Understand the Inflow and Outflow of Cash

Cash flow is the lifeblood of any business, and the Cash Flow Statement helps you understand how cash moves in and out of your company. This report breaks down cash flow into three categories: operating activities, investing activities, and financing activities. It shows how much cash your business generates from its core operations, how much is spent on investments, and how much is borrowed or repaid through financing.

By reviewing your Cash Flow Statement, you can identify periods of cash shortfall or surplus and plan accordingly. For example, if your cash flow is consistently negative, you may need to take steps to increase revenue, reduce expenses, or adjust your payment terms with customers.

A bookkeeper will prepare and analyze your Cash Flow Statement, ensuring that you have a clear understanding of where your cash is coming from and where it’s going. They’ll help you identify trends and potential issues, allowing you to take proactive steps to manage your cash flow effectively. This report is particularly valuable for businesses with seasonal fluctuations in revenue, as it helps you plan for slow periods and ensure you have enough cash on hand to cover expenses.

4. Accounts Receivable Aging to Manage Customer Payments

Managing customer payments is critical to maintaining healthy cash flow. The Accounts Receivable Aging Report is a tool that helps you track which customers owe you money, how much they owe, and how long their invoices have been outstanding. This report categorizes outstanding invoices based on the length of time they’ve been overdue, typically in 30-day increments (0-30 days, 31-60 days, etc.).

By reviewing the Accounts Receivable Aging Report, you can identify which customers are slow to pay and take action to collect overdue balances. This report is essential for improving cash flow, as late payments can severely impact your ability to meet your own financial obligations.

A bookkeeper will regularly generate and review your Accounts Receivable Aging Report, ensuring that customer payments are being tracked and managed effectively. They can also assist with following up on overdue invoices and implementing systems to encourage faster payment, such as offering discounts for early payment or sending automated reminders.

5. Budget vs. Actuals Report to Track Financial Performance Against Forecasts

The Budget vs. Actuals Report compares your actual financial performance to the budget you’ve set for your business. This report helps you track whether you’re staying on track with your financial goals or if adjustments need to be made. It provides insight into areas where your expenses may be higher than anticipated or where revenue may be falling short.

By regularly reviewing this report, you can make data-driven decisions to adjust your budget, reduce unnecessary spending, or reallocate resources to more profitable areas. The Budget vs. Actuals Report is crucial for managing your business’s long-term growth and sustainability.

A bookkeeper will prepare and maintain your Budget vs. Actuals Report, ensuring that you have real-time insight into your business’s financial performance. They’ll help you set realistic budgets based on historical data and monitor how well your actual results align with your goals. If discrepancies arise, your bookkeeper can provide recommendations for getting back on track.

Understanding these five key financial reports is essential for every small business owner who wants to maintain control over their business’s financial health. However, managing these reports requires time, expertise, and accuracy. That’s where partnering with a professional bookkeeper can make all the difference.

A bookkeeper will not only prepare these reports for you but will also provide valuable insights into how you can use them to make informed decisions and grow your business. By maintaining accurate financial records and analyzing trends, a bookkeeper helps you avoid financial pitfalls and stay on track with your goals.

At Beaver Bookkeeping, we specialize in providing small businesses with the financial clarity they need to succeed. With over 20 years of experience, we can help you create and maintain these critical financial reports, ensuring that you have the information you need to make strategic decisions.

Need help understanding your business’s financial health? Contact Beaver Bookkeeping today for a free consultation! Let us help you create and maintain the financial reports that will drive your business’s success.